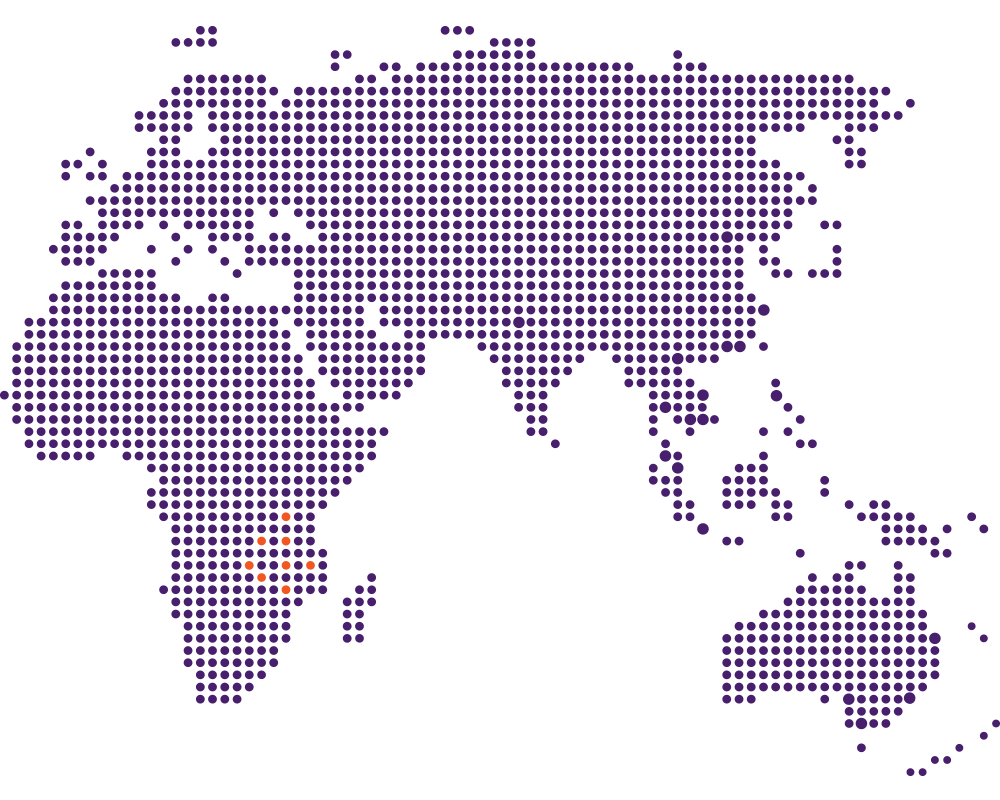

Tax compliance in East Africa

EAC Partner States have well-established tax regime and national revenue authorities that are responsible for assessment, collection and accounting for all revenues that are due to the government in accordance with the national laws. Taxes applicable to business entities include Corporate Tax, Withholding Tax (WHT), Excise Tax, Value Added Tax (VAT) and capital deductions.

Managing tax and statutory compliance in today’s highly complex economic and regulatory environment is no easy task. Rapid globalization, new developments in tax laws, changes in accounting standards and increased demands from tax authorities are all increasing the burden on tax and finance departments. At the same time, they must provide more and better reporting and compliance, in less time.

Companies are looking for more consistent, efficient and cost-effective ways to meet their compliance obligations. That is where our Tax Compliance Management Services teams come in.

The services we provide help our clients to transform the way they manage compliance and include:

– tax compliance and related tax planning

– tax provision preparation

– statutory accounting, bookkeeping and

– payroll compliance

– compliance process, data extraction

– technology and control advice

– project coordination and management

OCL business associates team of professionals works to provide a clear, logical approach to help companies design, implement and manage a compliance structure that encompasses the specific needs of the client’s organization.

Recent tax reforms in the East African countries have largely been about digitizing tax platforms. The era of filing manual tax returns has come to an end and tax returns and payments are now being done online.

Contact OCL business associates to be tax compliant in Kenya ,Uganda, Tanzania , Burundi ,Rwanda ,DRC Congo and south Sudan.